We help you express the kindness of Jesus to people living in the toughest places on earth.

When you partner with Unto®

- You relieve both physical and spiritual suffering of people.

- You can be assured your partnership makes a difference in people’s lives.

- You join us and others like you to meet needs around the world.

By giving, praying, or volunteering, you help ensure people living in the toughest places on earth no longer suffer without life-saving essentials and without the opportunity to respond to the eternal hope of Jesus.

You can meet needs around the world

As the humanitarian ministry of Cru®, Unto has leveraged strategic global partnerships to relieve suffering through humanitarian aid:

- For nearly 30 years

- In more than 75 countries

- With access to Cru’s 190-country network

Partnerships with people like you make it possible for Unto to provide humanitarian assistance and coaching to our Cru national partners, giving them access to people who might otherwise be unreachable.

In many cases humanitarian aid is the main reason authorities allow ministry to continue in some of the toughest places on earth.

Stay connected with Unto® through email updates that share stories and opportunities for you to show kindness through humanitarian aid. And for signing up today, you can download free phone wallpapers!

Stay connected with Unto® through email updates that share stories and opportunities for you to show kindness through humanitarian aid. And for signing up today, you can download free phone wallpapers!

Food and Agriculture

Families receive nutritious meals when food is scarce or seeds for long-term, sustainable food solutions for entire communities.

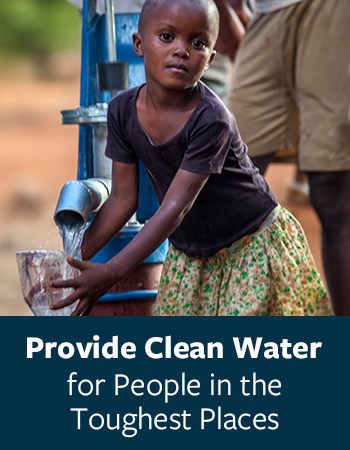

Clean Water

Critical Aid

Modal Title

CONNECT WITH UNTO

And Download FREE Phone Wallpapers!